A (Millennial) Economic Warning

Photo by Bermix Studio on Unsplash

If you are a Millennial, you are part of what is being called “The Unluckiest Generation in US History.” The one experience Millennial Americans all share is that our early adult years have been dominated by an economy that has failed us over and over again, says Joseph Sternberg.

Moreover, 70% of Millennials say they would vote for a Socialist. After a year of observation and study, I’m confident that the financial condition and political views of Millennials are highly correlated.

The Unluckiest Generation in US History

The Millennial financial condition looks something like this (all metrics being inflation-adjusted):

The average Millennial has less than $8,000 in their savings account (Business Insider).

1 in 4 millennials is forced (because they can’t afford their own place) to live with their parents (Forbes).

Millennials are delaying getting married because they do not feel financially stable enough (MarketWatch). Interestingly, once they do get married, they are staying married (Slate).

Millennials have fewer children because they don’t feel like they can afford it (Business Insider).

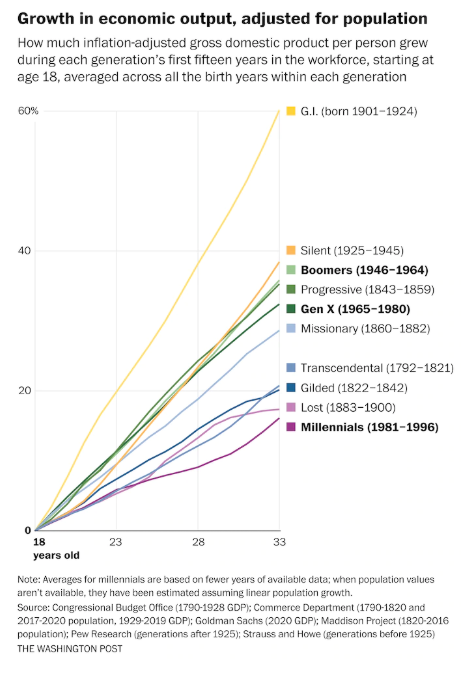

Millennials earn 20% less than Baby Boomers did at the same age, despite being better educated. This lower pay gap has been linked to slowing long-term wealth, among other things, too (CNBC).

Millennials will pay 39% more than a Baby Boomer to purchase their first home, and home values have increased by 73% since the 1960s when adjusted for inflation. (BusinessInsider).

Education costs have soared out of control. From the 1980s to 2018, the cost of an undergraduate degree rose by 213% at public schools - remember this is adjusted for inflation (BusinessInsider).

Average weekly childcare costs have nearly doubled from 1985 to 2011 alone. Childcare and pre-college education make up 18% of the total cost of raising a child today, compared to just 2% in 1960 (Washington Post).

Not that I’m an example of what a Millennial should be (far from it), but Millennials are more fit than any other generation (Salon). Why then do we have to pay insane health care costs attributable to earlier, less healthy generations? The average annual health insurance cost per person was $146 in 1960. It was $10,345 in 2016. That’s 900% higher, adjusted for inflation (CNBC).

Vehicle insurance is 50% higher, and maintenance is 27% higher in just one decade (BLS.gov).

While productivity in this country has continued its meteoric rise, wages have stagnated. Why should I be forced to work more hours, to make less money, while generating more output than those before me, in a world where cost of living has outgrown the ability to afford a middle class lifestyle? That productivity to compensation ratio is benefitting someone, and it certainly isn’t the worker. The gap between those with (Haves) and those without (Have Nots) does appear to be increasing, and it’s increasingly difficult to afford a middle class lifestyle on a single income. When that kind of despair (dare I say reality) comes into full view, I can imagine how a Have Not can justify saying “no more.”

Monetary policy is largely to blame for this condition, and it risks The American Dream.

Monetary (Boomer) Policy

The oldest Millennials, including myself, who were born from 1982-1985 graduated into The Great Recession and have been disadvantaged ever since. It’s certainly the worst economic situation since the Great Depression.

Deleveraging an economy like ours can be a brutal process - look no further than Japan which is nearly three decades into such a situation, now being forced to experiment with Negative Interest Rate Policy (NIRP).

In more recent years, we have witnessed the reckless spending of drunken, Keynesian Baby Boomers that seem to believe printing fiat currency is the solution to everything. They use the Central Bank as the best way to manipulate an economy, going as far as to lobby that Central Banks abandon their traditional role and get involved in politically charged lending policy. We’ve witnessed Quantitative Easing (to infinity), and about 20% of all dollars in circulation today were printed in 2020.

How do we think all this deficit spending is going to work out?

An Inflationary Environment

The closer you are to the Central Bank and Wall Street, the better positioned you are to gain. Is it any wonder, then, that only the richest have benefitted from all this monetary policy?

The culmination of decades of Keynesian monetary meddling leaves us wondering when or if hyper-inflation will creep in. The thing about inflation is that it benefits the rich, too. The Internal Revenue Service, mortgage debtors, the US Treasury, real estate developers, corporations, and coal miners all stand to benefit from inflationary pressures as the WSJ wrote in Meet the Inflation Profiteers.

Wages are simply not keeping up with inflation. Consumer price inflation in April rose 4.2% from a year earlier while hourly pay for production workers rose 1.25%, the Labor Department reported last week. The department also said that, after adjusting for inflation, wages of production workers and nonmanagers fell 3.3% in April from a year earlier, the largest such decline since an inflation shock and recession in 1980.

As Karen Petrou, a financial analyst and author of Engine of Inequality, a critique of Fed policy writes, “a decade of the Fed’s low-interest-rate policies have mostly helped the wealthy by pushing stocks higher.” The wealthiest 10% of US households own 88.5% of stocks, according to Fed data. Inequality Would Widen if US Policies Spur Sustained Inflation (WSJ). 1921 the dollar was worth 1,500 milligrams of gold; now, it’s worth 17.

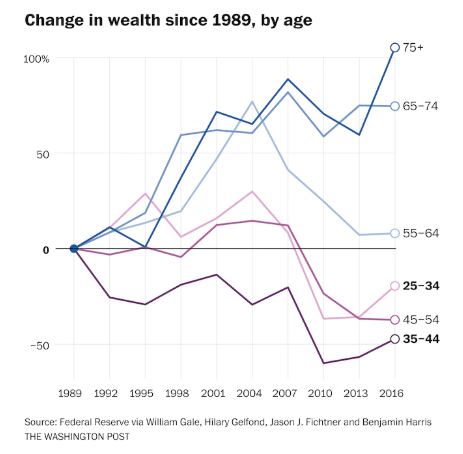

The increasingly binary financial condition of an American - towards Haves and Have Nots - appears to be minted along generation lines, too. The change in wealth since 1989 has benefitted the Boomers and hurt the younger generations.

Ignore This Warning? Expect Socialism.

“The earnings gap between older and younger male workers has widened from 11% in 1970 to an astonishing 41% in 2011. ”

When I was young, my parents told me that if I followed this formula, I could do and be whatever I wanted to - that I could find as much success as I wanted and become part of the wealthiest class in the world:

Listen to and respect your elders

Study hard and got good grades

Stay away from drugs and other vices

Play competitive sports

Go to college (and get more good grades)

Graduate with a valuable degree

Work hard

Give back to your community

Open a savings account and save

This is a formula that many of us grew up with, and one that has failed an entire generation. We’ve spent far too much money on an education that doesn’t pay. We’ve worked too hard for too little money. We’ve sacrificed while watching our government hand out trillions to failed businesses (that’s called Crony Capitalism) and line the pockets of those closest to Washington DC. It’s no wonder one out of two people who move to DC become a millionaire. Whatever you’re able to save is wiped out by the new economy that we find ourselves in, too. The formula is broken.

“Millennials own 7% of America’s wealth by comparison to a Baby Boomer who owned 21% of the nation’s wealth at the same age.”

It should be glaringly obvious now that there is a strong correlation between the Millennial’s financial condition and their increasing acceptance of Socialism.

No matter how well-intentioned the Baby Boomers’ reign has been - the longest and most influential reign of any generation in American history - what it’s produced has largely failed. Why am I paying into a system like Social Security, that will reward an already rich generation only to be bankrupted by the time they pass on? Who is going to pay the bill for Quantitative Easing to Infinity? Who is going to pay for the partisanship and single-policy politics that has brought Washington to its knees? Who is going to pay for the legalized opioid epidemic that the rock-n-roll generation created? Why should we subsidize healthcare premiums for the overweight generation? That’s a hard take, I know. I largely don’t fault them for burying their head in the sand and refusing to take any responsibility for any it. I wouldn’t want to look in the mirror, either.

They fail to recognize their own defensiveness and dismissiveness. If that doesn’t change quickly, the largest voting block in the United States will end up embracing socialism out of exasperation, believing if hard work can’t get them there that it might be better to redistribute wealth from the top down. They will accept that it’s best to take from people who don’t work hard for it (CEO compensation has grown 940% since 1978, while the worker has only grown 12%). Lest they think they are smart, how hard is it to build wealth when you’re able to annualize >8% for decades by doing nothing more than existing?

We need to create a more equitable system for an entire generation that is suffering from policies that they are not responsible for and for which they unfairly suffer. Woe to you who Have and remain deaf to this warning.

A Final Note to all my fellow Millennials

Boomers are right that many of you do whine a lot and revert to a victim mentality (don't crucify me for saying it or agreeing with them, in part). You can persevere. Do not be a victim; be the conqueror! Knowledge can be power. Let this light a fire under your ass to prove them all wrong! You’re the fittest and most educated generation in the history of this country! You’re not lazy; you just haven’t had your time yet! Press on. As the Chinese say, there are no fish in clear waters. The waters today are murky and the markets are volatile. Therein lies opportunity.